Exceptions to the Rule: Calamities Business Insurance May Not Cover

Exceptions to the Rule: Calamities Business Insurance May Not Cover

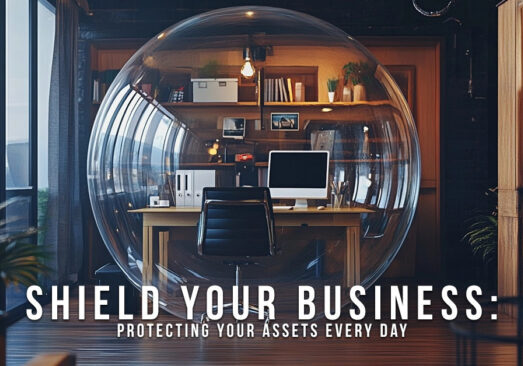

Recent events across the country and the world have created lively discussions about business insurance and what may or what may not be covered. Much of this discussion is centered around Business Interruption Insurance.

It can be helpful to understand that virtually every form of insurance has exclusions, limitations, or will require a separate policy or additional rider on the main policy to cover certain circumstances. With homeowners’ insurance, for example, damage from flooding is not covered under the basic policy but must be secured separately. Likewise, backyard trampolines will likely not be covered by homeowners’ insurance and may even invalidate a homeowners’ insurance policy. There are other examples as well both in consumer and business insurance.

Business interruption insurance generally covers financial losses due to physical damage to a business or its inventory by a covered calamity like a fire or storm damage. In some cases, financial losses sustained from a loss of business due to a virus like COVID-19 would be exempt from coverage.

On the other hand, if a business has sustained damage due to rioting and is forced to close their doors because of the civil unrest, income losses under a business interruption policy may be covered. Not only would a business be covered under the vandalism provisions of a policy but because there were physical losses, business interruption coverage would also likely be in effect.

Some businesses may have been taken aback by the lack of coverage under some circumstances. It reinforces the importance of an occasional business insurance policy review. Businesses should carefully weigh the benefits of Business Interruption Insurance and understand its limitations. They should, at the very least, understand what is and isn’t covered under a policy and address any gaps they may be uneasy with ahead of time.

If it has been longer than you can remember since your business has had an insurance review, we invite you to contact one of our independent agents. They will discuss your specific risks, concerns and potential solutions. They will then go in search of a policy that suits your needs at a price that you can feel comfortable with. Contact us today.

Your Personal Insurance Shopper

Contact Us

OUR LOCATION

15 W. 5th St. Ste A Morgan Hill, CA 95037

1-408-776-2800

CA License #0D91044

© Copyright 2024 Ram Commercial Insurance Services, LLC | All Rights Reserved

Site by ICA Agency Alliance

15 W. 5th St. Ste A Morgan Hill, CA 95037

1-408-776-2800

CA License #0D91044

© Copyright 2024 Ram Commercial Insurance Services, LLC | All Rights Reserved

Site by ICA Agency Alliance